Improved Regulatory Compliance for Claims Adjusters in GuidewireCopy Link

Get a Demo

Overview

The insurance company struggled with claims adjusters being unaware of new and existing state laws when processing and settling insurance claims, leading to compliance risks and inefficiencies. By leveraging Whatfix’s in-app guidance and Self Help, the company enabled its claims agents, leading to enhanced regulatory compliance, faster claims processing, and improved productivity of end-user agents.

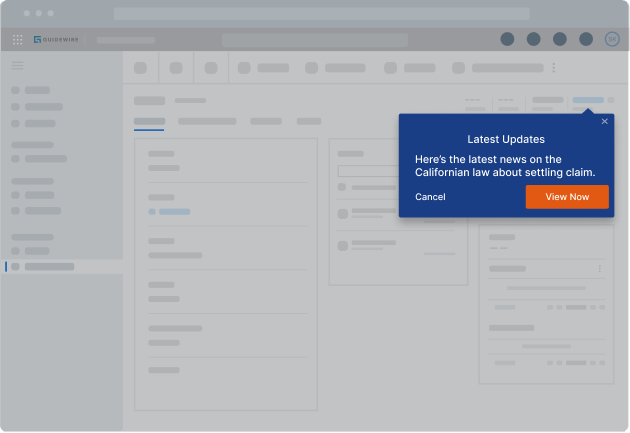

Preview

The Problem

Claims adjusters often lacked awareness of the latest state laws and regulations when processing and settling insurance claims, resulting in longer processing times, a poor policyholder experience, and a heightened risk of non-compliance with local laws.

The Whatfix Solutions

Whatfix enabled agents with Self Help, providing an in-app help center in Guidewire that integrated with the insurance provider’s knowledge repositories, process documentation, procedural needs, and compliance resources. This created a “one-stop shop” for claims agents to quickly find documentation and resources to follow correct procedures. Additionally, Smart Tips were deployed throughout the claims processing workflow. Examples of Smart Tips included updates on state laws for timely claim settlements, alerts for mandatory insurance code forms in catastrophe claims, and prompts for filing FIR forms in the case of vehicle theft claims.

Value on Investment

Saved $193K by improving claims settlement compliance with state laws.

Improved Guidewire data quality and process governance with in-app Field Validations and Smart Tips.

Improved claims agent productivity through in-app Guidewire guidance and on-demand support.

Accelerated claims processing time, which improved policyholder experience.

Looking to experience Whatfix for yourself? Go for it.

Request a Whatfix Demo