Reduced Claims Leakage with Guided Duck Creek Reimbursement ProcessCopy Link

Get a Demo

App Type:

Insurance SoftwareIndustry:

InsuranceApp Name:

Duck CreekWhatfix Product:

Whatfix DAP, Whatfix Product Analytics

Overview

The insurance company faced challenges with payment errors and overpayments due to inexperienced adjusters and manual processes, leading to claims leakage. By implementing Whatfix’s product analytics, in-app guidance, and automation on Duck Creek, the company reduced errors, improved data quality, and enhanced the overall efficiency of claims processing.

Preview

The Problem

Inexperienced adjusters and manual processes led to frequent payment errors and overpayments to policyholders. Documentation was either outdated or incomplete, and there was a lack of contextual training for claims agents on handling different reimbursement situations. These issues resulted in an inefficient claims process, decreased profitability due to over-reimbursement, and unconfident claims agents.

The Whatfix Solutions

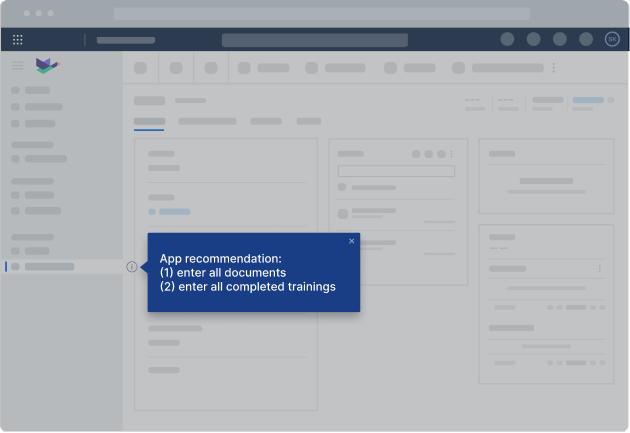

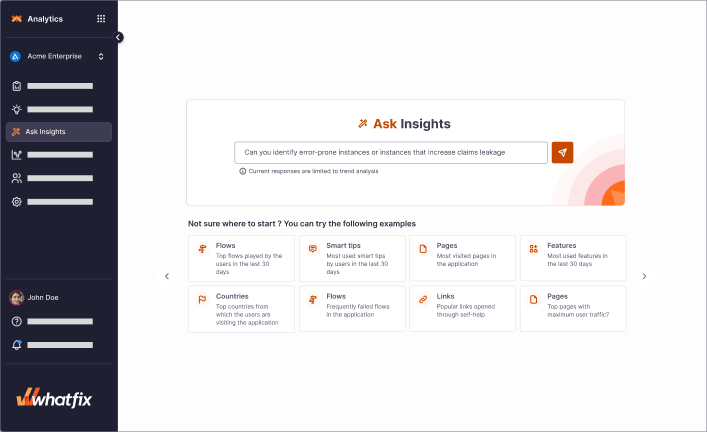

Whatfix Product Analytics was leveraged to identify areas where process errors or data entry mistakes were causing claims leakage. Smart Tips and Data Validation were then deployed in Duck Creek where errors were taking place to provide real-time support to claims agents during insurance payment processing, ensuring that all necessary policyholder information was accurately captured for pre- and post-claim investigation. Additionally, Whatfix automated workflows for repetitive and mundane tasks in Duck Creek, minimizing the need for human intervention and reducing errors.

Value on Investment

Accelerated claims processing by reducing manual errors and optimizing workflows.

Reduced claims leakage and improved data quality,

Saved $443K due to frictionless claims process.

6x ROI from Duck Creek due to improved claims management efficiency and higher claims agent adoption.

Looking to experience Whatfix for yourself? Go for it.

Request a Whatfix Demo