Tracking and Validating nCino Underwriting Process Time-to-Completion ImprovementsCopy Link

Get a Demo

Overview

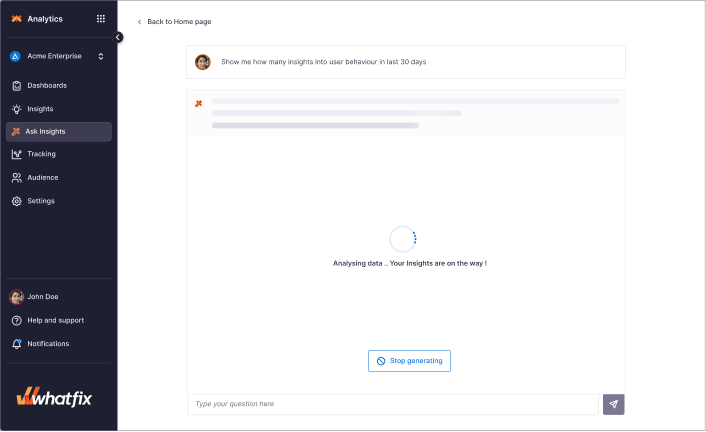

A financial services company used Whatfix Product Analytics to track user behavior and process completion times in nCino. This data validated the effectiveness of a new underwriting process, reducing average completion time by over 3 hours, aligning with key business metrics.

Preview

The Problem

The company lacked a system to track user behavior and completion times for processes in nCino. Feedback from users suggested that nCino processes were complicated, but this was based on informal feedback rather than quantitative data. The team estimated the older process took 4-6 hours but needed concrete data to validate it. They also believed the new nCino process could improve underwriter productivity but required data to support this assumption. Validating underwriting efficiency was essential to meet the sponsor's OKRs and the product manager's KPIs. Identifying pain points was critical to further refining nCino's underwriting process.

The Whatfix Solutions

Whatfix Product Analytics was implemented to track user actions and time spent on each step of the commercial loan creation process in nCino. Using Whatfix Journeys and Funnel Insights, the company gained detailed insights into user behavior, process time-to-completion, and areas where user friction occurred.

Value on Investment

Provided quantitative data which validated that the old nCino underwriting process took an average of 4 hours and 8 minutes to complete.

Analyzed the new nCino process which showed a time-to-completion improvement of over 3 hours per user, down to 1 hour and 12 minutes.

Looking to experience Whatfix for yourself? Go for it.

Request a Whatfix Demo