Reduced Loan Approval Times Through Improved nCino Process ComplianceCopy Link

Get a Demo

Overview

This banking company faced challenges with frequent errors in loan documentation and verification processes on nCino, leading to increased support tickets and delays in loan approval. By implementing Whatfix’s in-app guidance, the bank improved process compliance, reduced errors, and accelerated loan approval times.

Preview

The Problem

Loan agents and borrowers encountered frequent errors in the nCino loan documentation and verification process, resulting in a high volume of support tickets that strained resources and reduced the bank's capacity to address complex queries. Delays in loan verification were also caused by a failure to keep up with regulatory changes. These issues risked the bank's reputation, led to borrower fallout due to longer approval times, and caused data quality problems due to errors in data entry, ultimately impacting the borrower experience.

The Whatfix Solutions

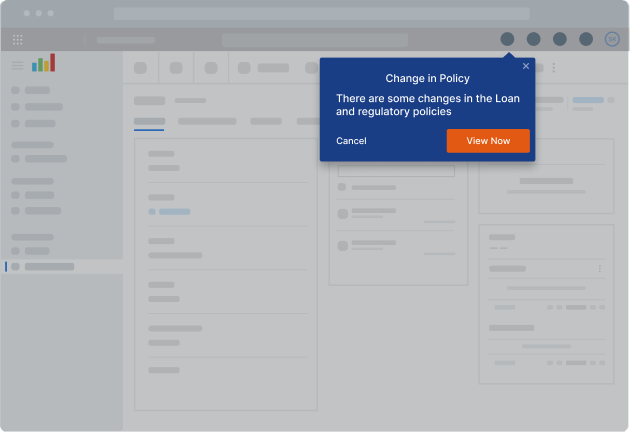

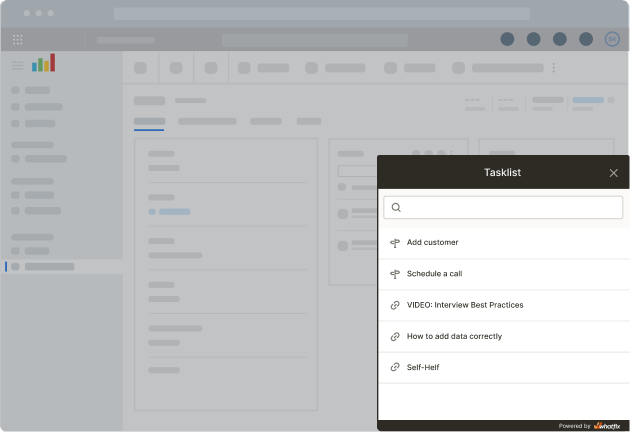

Used Whatfix to implement Pop-Ups that alerted loan officers of any changes in loan policies or regulatory requirements. Flows were created to guide loan officers through preferred loan approval actions and provide step-by-step support throughout the loan approval journey, ensuring compliance with correct processes. Smart Tips and Task Lists were also set up to ensure accurate data entry and process governance within nCino tasks and workflows.

Value on Investment

Growth in the number of loans processed and increased profitability through error-free loan document creation, verification, and updating of key customer information by loan agents.

Savings of $150K due to improved loan process compliance.

Prevention of the bank's reputational risk from mitigating loan non-compliance.

Looking to experience Whatfix for yourself? Go for it.

Request a Whatfix Demo