Accelerated Legacy Loan System to nCino Digital Banking TransformationCopy Link

Get a Demo

Overview

The bank faced challenges in transitioning from legacy systems to nCino's digital banking platform, resulting in knowledge gaps, increased support tickets, and delays in loan approvals. By leveraging Whatfix’s in-app guidance and tailored training content, the bank accelerated employee proficiency, improved process efficiencies, and maximized the ROI of the nCino transformation project.

Preview

The Problem

As part of its digital transformation, the bank faced significant change management challenges in migrating from desktop-based legacy applications to nCino’s cloud-based digital banking platform. Knowledge gaps among employees, especially older ones like baby boomers and millennials, led to slower customer data processing and increased need for nCino-specific process support across different departments. This lack of targeted onboarding and upskilling materials resulted in a high volume of nCino-related support tickets, delays in loan approvals, and borrower fallout due to longer approval times.

The Whatfix Solutions

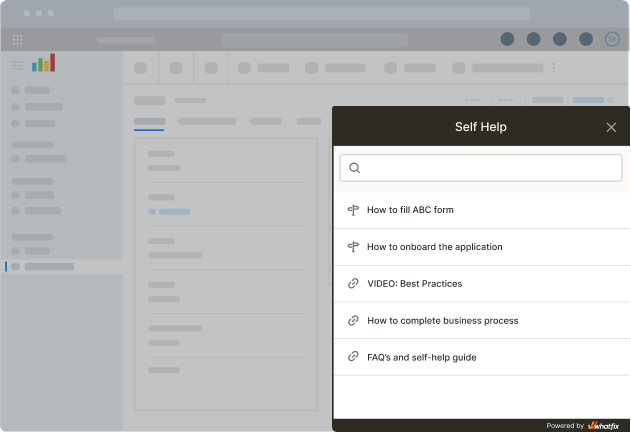

Whatfix created Flows specific to nCino processes, guiding users through the preferred journey to complete various banking tasks and processes. Role-based contextualized training was developed to help loan origination teams complete industry-specific processes faster. Tailored and targeted Self Help content was provided based on usage analytics, enabling existing users to transition seamlessly across the nCino platform.

Value on Investment

Grew deposits and loan accounts due to improved process efficiency.

Accelerated employee time-to-proficiency on nCino and a reduction in support tickets.

Increased loan process efficiencies, enhancing overall employee productivity.

Maximized ROI of the nCino transformation project through effective adoption and usage tracking.

Looking to experience Whatfix for yourself? Go for it.

Request a Whatfix Demo